It has been a busy first half of the year in real estate. The market has taken time to adjust to the regulatory changes of the 16 Point Fair Housing Plan implemented a year ago and the B-20 Mortgage Qualification changes that came into effect on January 1st. These changes coupled with a long winter, the Provincial Election, uncertainty surrounding Trade Tariffs, and an exciting World Cup, have likely caused a few people to pause on their real estate decisions.

Now for the good news! We are experiencing a strong economy with historically strong employment levels at 40 year highs, continued historic growth in population, historically favourable interest rates and despite the daily headlines, our number one trading partner has a strong economy as well! This combination of real fundamentals are sometimes difficult to remember in this new age of on line news media that we are constantly bombarded with every minute. The very fact that we all need somewhere to live and this amazing place called the GTA, continues to be one of the best places in the world to live means the future of our market is bright and strong.

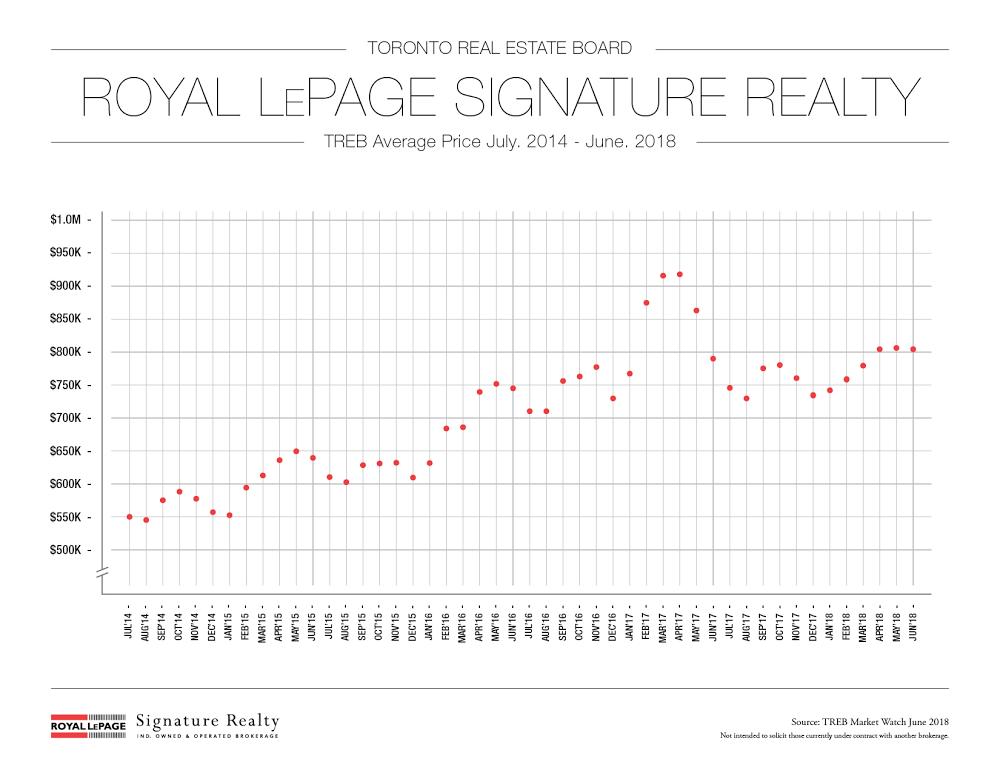

When there is change in the market, consumers take longer to make decisions, they need clear indication that it’s okey to own real estate and confidence that in the future it will be worth more. I’m certain that we are reaching that point in the market this year and the second half of 2018 will see more unit sales than the first half. The very fact that people can only wait so long before they need to act, the fact that June will likely be the first month this year that we will see a positive year over year average price appreciation and the continued positive economic news will all help to build consumer confidence and ultimately cause them to act.

What about rates? It’s another positive sign that confirms our economy is on a strong footing, that inflation does exist and that means we need to raise our rates. Another quarter point change will not have an effect on consumers as the Mortgage rates will not move significantly ( a .25% raise on $500,000 mtg is $60/month). Again, it is imperative that we cut through the noise of negative news and truly understand what the impact of this change means so that we are able to help our clients make great decisions about their real estate needs.

There are still multiple offers in certain areas of the GTA, specifically for First Time Buyer price points such as condos. This confirms that the base of the market is strong and consumers do inherently understand the value of home ownership. The Millennial Generation, which is larger than the Baby Boomer Generation, are just entering the market coupled with our population growth, continues to place pressure on Condos. We can’t build housing fast enough to accommodate the population growth strategy that the Federal government has implemented which is clearly illustrated by the effects on rental rates in our market. This continues to make investing in real estate an excellent choice as it has been for decades.

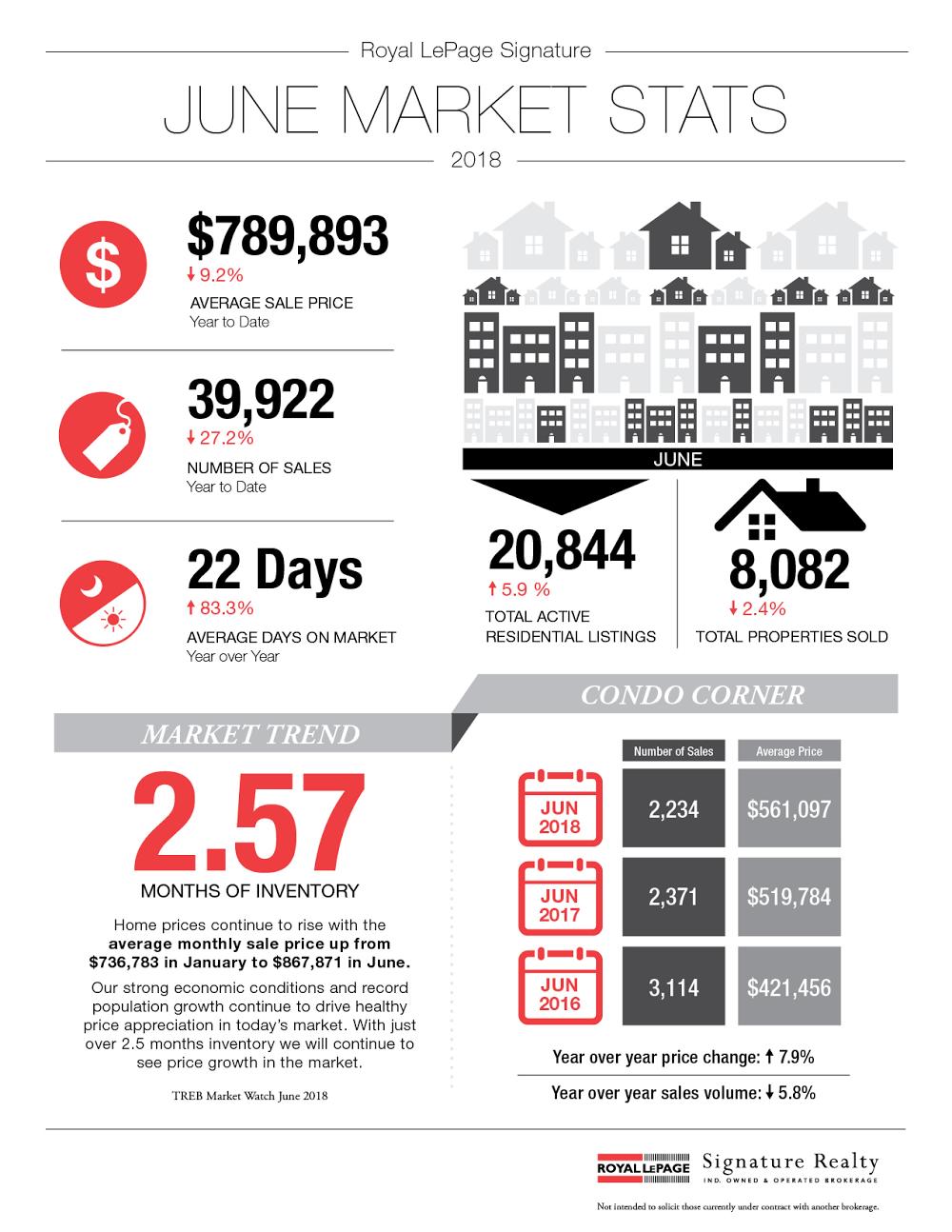

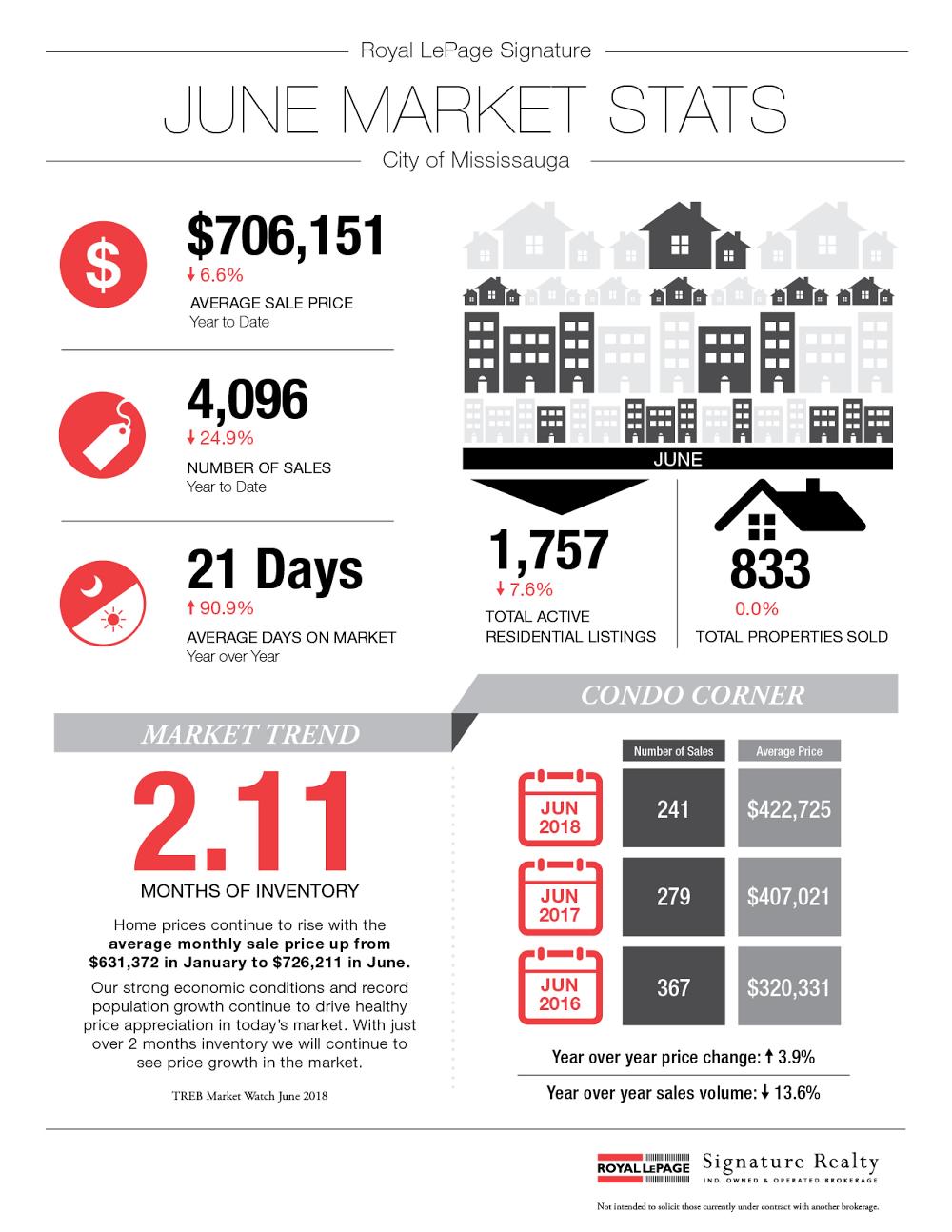

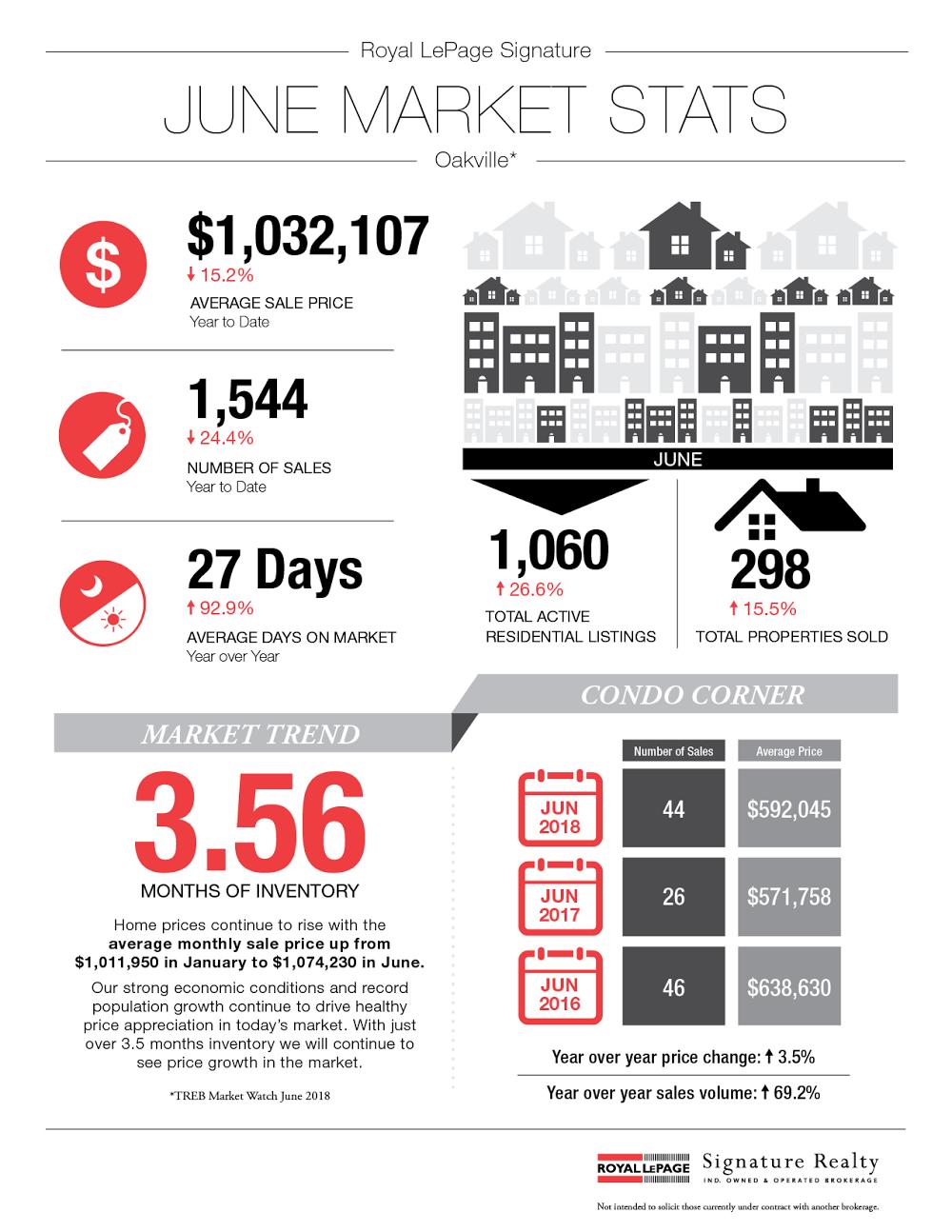

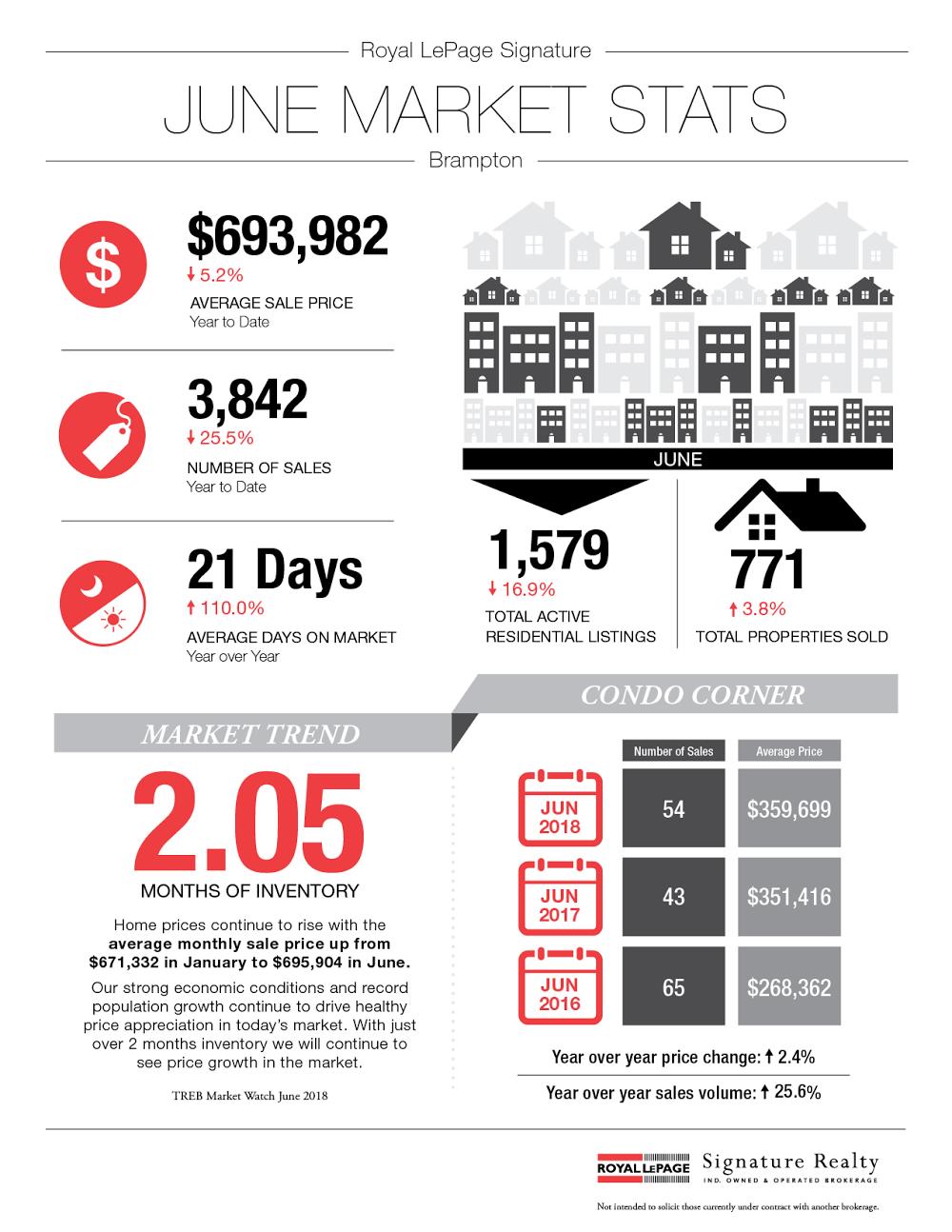

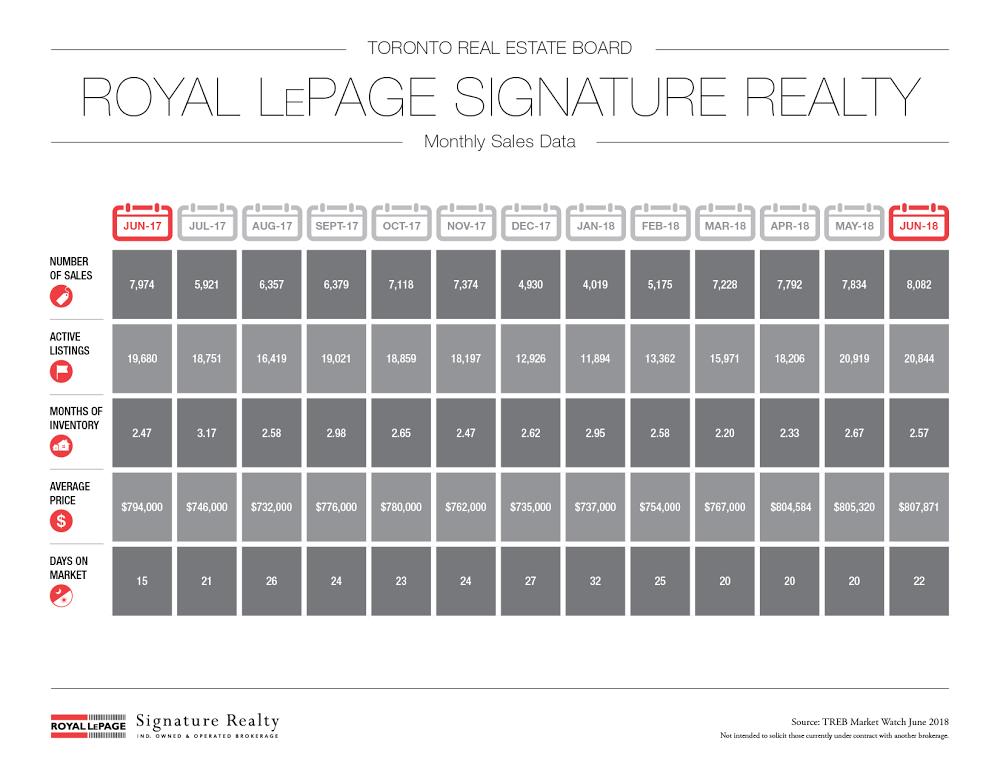

Below you will find stats for the month of June for Toronto, Mississauga, Oakville and Brampton. The market really has been shifting to a more normalized rate of appreciation with the average price in June up 2% over June last year and sales volume up 2.4% over the same period last year. These results further clarify that our market has a strong foundation and will help build confidence in buyers and sellers alike.

Post a comment